City Projects Unfunded Liability to be Below $1.5 Million

Tuesday (10/11), Prescott City Council voted to adopt Ordinance No. 2022-1801 eliminating the 0.75% Transaction Privilege Tax Dedicated to Paying Down the City’s Unfunded Liability in the Arizona Public Safety Personnel Retirement System (PSPRS), effective December 31, 2022. The City is projecting that the unfunded PSPRS liability will be below $1.5 Million, which according to the voter approved Proposition 443, allows the tax to sunset.

On August 29, 2017, the voters approved a dedicated transaction privilege tax of 0.75% to pay down the PSPRS unfunded liability. The tax took effect on January 1, 2018, and was set to end the earlier of December 31, 2027, or at such time as the City’s PSPRS unfunded liability is $1.5 million or less as determined by actuarial value.

At the time of the election, the City was only 30% funded in our PSPRS trust funds. The City was not able to maintain service levels in the General Fund because of the escalating PSPRS annual required contributions caused by the high unfunded liability in the City Police and Fire trust funds. At one time the City’s PSPRS unfunded liability was over $86 Million.

Prior to the election, Council made the commitment that additional General Fund Balance would be sent to PSPRS trust funds. Council also committed to continuing the annual required contributions out of the General Fund each year. These steps, along with a stronger than projected transaction privilege tax, resulted in the City being able to end the tax December 31, 2022, five years before the 10-year deadline.

According to City Budget and Finance Director Mark Woodfill in a memo to Council; “Since actuarial valuations for our PSPRS trust are not available until six months after year-end and we are required to give the Arizona Department of Revenue (ADOR) advance notice of changes in our local tax rate, we had to project our unfunded liability. We have to project 18 months from the June 30, 2021, actuarial validation to December 31, 2022. Our projections show that we will achieve an unfunded liability below the $1.5 million identified in the ballot language, by December 2022.”

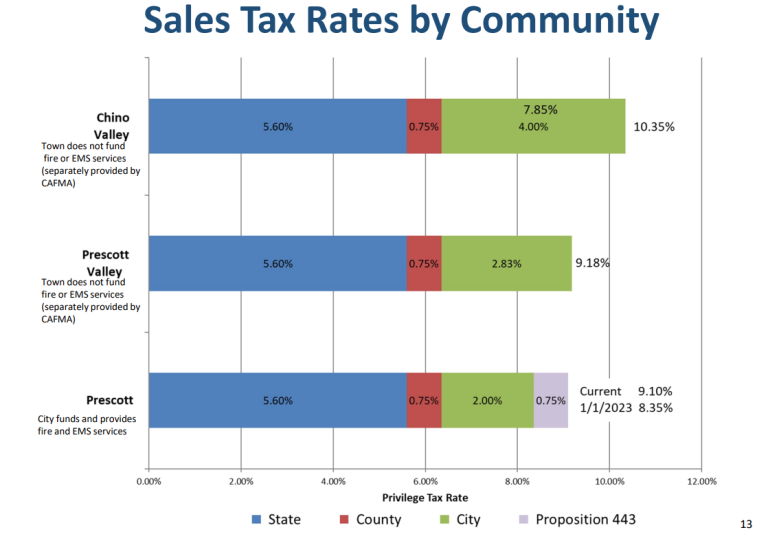

As of January 1, 2023, Prescott’s sales tax will drop from 9.1% to 8.35%. According to the Council memo taxpayers shall be notified of the rate change via social media, the local newspaper, and the City of Prescott website. In addition, the Arizona Department of Revenue (ADOR) will include the rate change information on the ADOR website and will be included in the newsletters that are sent out to subscribers. This dedicated tax has reduced the City’s unfunded liability at PSPRS reducing the escalating pension payments stabilizing the City’s General Fund.

How useful was this article ?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

We are sorry that this post was not too useful for you!

Let us improve this post!

Tell us how we can improve this post?

1 thought on “Prescott City Council Agrees to Sunset .75% PSPRS Tax December 31, 2022”

If this tax reduction sticks it will be a further boom to buying that new car or $2000 refrigerator in Prescott. With a much higher rate in Prescott Valley and Chino Valley it would behoove Prescott Valley and Chino Valley to reduce their franchise privilege tax as well.

I was at the PV council meeting when senior town staff presented a one sided presentation on a half percent increase which was NOT needed. The FPT was growing at a tremendous rate and the higher costs of road resurfacing and additional police would be covered without a higher town tax increasing our cost of groceries and everything else.

Remember, no government has any money until and unless it takes it from you and me in the form of taxes and fees.

Comments are closed.